How UK Pension Calculator Works

Understand the methodology, calculations, and features behind our suite of UK financial calculators. Learn how our tools help you plan effectively for retirement and financial security.

Our Financial Planning Tools Explained

We've developed a comprehensive suite of financial calculators to help you plan for every aspect of your financial future. From pension projections to mortgage affordability, our tools use reliable methodologies to provide accurate estimates tailored to your circumstances.

Our Financial Calculators

Pension Calculators

Financial Calculators

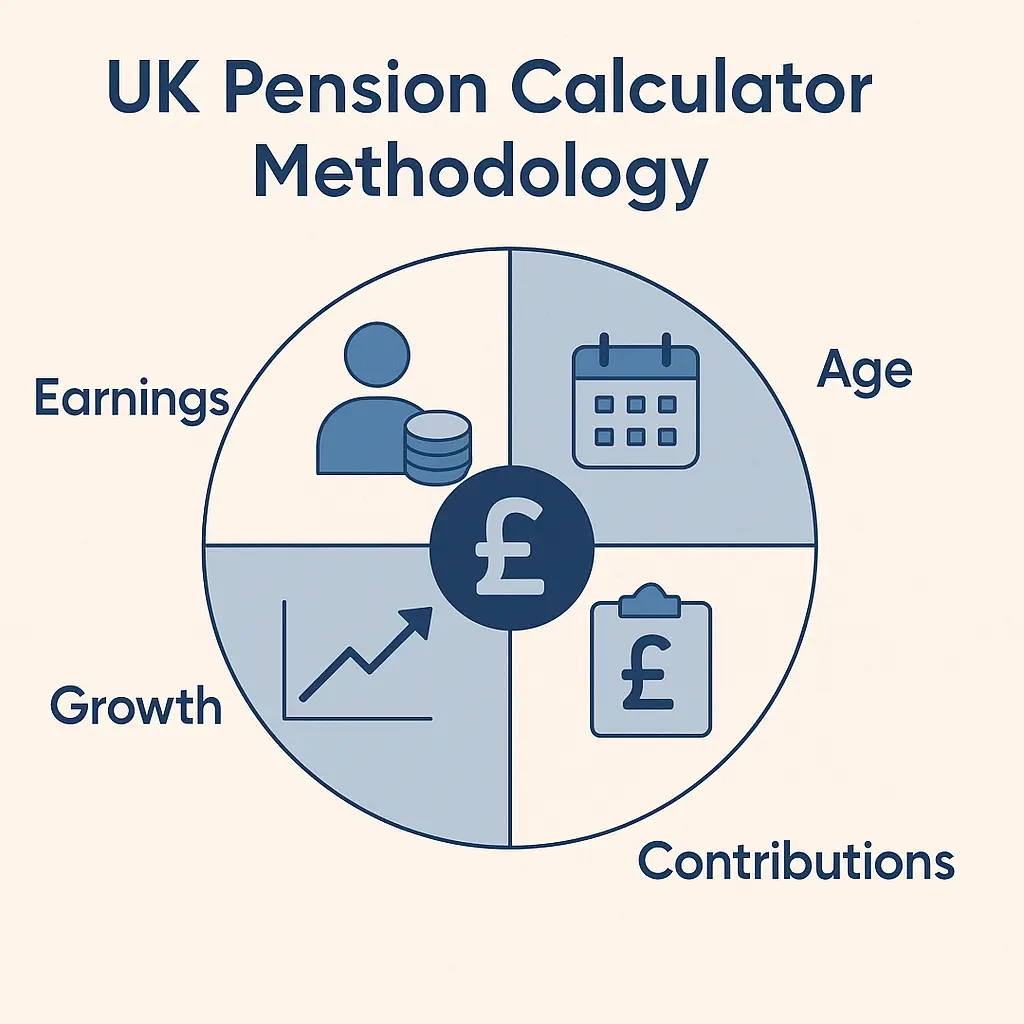

UK Pension Calculator

How It Works

The UK Pension Calculator provides a comprehensive overview of your potential retirement income from multiple sources, including State Pension, workplace pensions, and private pensions.

Key Features:

- Holistic View: Combines multiple pension types into a single forecast

- Retirement Gap Analysis: Identifies shortfalls between projected income and your retirement goals

- Income Replacement Ratio: Shows what percentage of your working income you'll maintain in retirement

- Inflation-Adjusted Projections: Accounts for the impact of inflation on your future purchasing power

Calculation Methodology:

The calculator uses several key factors to generate accurate projections:

- Current Pension Values: Your existing pension pots and their current balances

- Contribution Levels: Your ongoing contributions and employer matching

- Investment Returns: Projected growth based on historical market performance

- Tax Relief: Accounts for applicable tax benefits on pension contributions

- Retirement Age: Customizable based on your planned retirement date

- Drawdown Strategy: Calculates sustainable withdrawal rates in retirement

UK Armed Forces Pension Calculator

How It Works

The UK Armed Forces Pension Calculator is specifically designed for military personnel to estimate benefits across all Armed Forces Pension Schemes (AFPS), including AFPS75, AFPS05, and AFPS15.

Key Features:

- Multi-Scheme Support: Handles all military pension schemes, including transitions between schemes

- Rank-Based Calculations: Adjusts projections based on rank and service branch

- Early Departure Payments: Calculates EDP benefits for those leaving before normal pension age

- Death Benefits: Estimates survivor benefits and death grants

- McCloud Remedy Consideration: Accounts for potential benefits following the McCloud judgment

Calculation Methodology:

The calculator uses several scheme-specific approaches:

- AFPS75: Calculates pensions based on rank, length of service, and final salary with either immediate pension (IP) or preserved pension (PP) options

- AFPS05: Uses final pensionable salary and accrual rate of 1/70th per year of service

- AFPS15: Uses a Career Average Revalued Earnings (CARE) approach with 1/47th accrual and annual revaluation of CPI + 1.6%

- Mixed Benefits: Combines entitlements across different schemes for those with service spanning multiple schemes

UK Teacher Pension Calculator

How It Works

The UK Teacher Pension Calculator helps education professionals estimate their pension benefits from the Teachers' Pension Scheme, covering both final salary (pre-2015) and career average arrangements.

Key Features:

- Scheme-Specific Calculations: Handles both final salary sections (NPA 60 and NPA 65) and the career average scheme

- Service Credit Recognition: Accounts for full and partial years of pensionable service

- Flexible Retirement Options: Models normal, early, phased, and late retirement scenarios

- Additional Pension: Incorporates any additional pension contributions

- Commutation Options: Shows how exchanging pension for tax-free cash affects your benefits

Calculation Methodology:

The calculator applies different formulas based on scheme membership:

- Final Salary (NPA 60): Pension = Average Salary x Years of Service x 1/80, with automatic lump sum of 3x pension

- Final Salary (NPA 65): Pension = Average Salary x Years of Service x 1/60, with optional lump sum commutation

- Career Average: Accrual of 1/57th of pensionable earnings each year, with annual revaluation of CPI + 1.6%

- Early/Late Factors: Applies reduction/enhancement factors for retirement before/after normal pension age

- Death Benefits: Calculates death grants and survivor pensions based on scheme rules

UK State Pension Calculator

How It Works

The UK State Pension Calculator helps you estimate your State Pension entitlement based on your National Insurance contribution record and forecast what you might receive at State Pension age.

Key Features:

- National Insurance Analysis: Assesses your qualifying years and identifies any gaps

- State Pension Age Calculator: Determines your specific State Pension age based on current legislation

- Contracting Out Adjustment: Accounts for periods of contracting out from the additional State Pension

- NI Credits Recognition: Incorporates credits from Child Benefit, Carer's Allowance, and other benefits

- Gap-Filling Analysis: Provides cost-benefit analysis for voluntary National Insurance contributions

Calculation Methodology:

The calculator focuses on the New State Pension system (post-April 2016):

- Qualifying Years Assessment: Counts years with sufficient National Insurance contributions or credits

- Pro-rata Calculation: Pro-rates the full State Pension amount (£221.20 per week for 2024/25) based on your qualifying years

- Minimum Threshold: Checks if you meet the minimum 10 qualifying years requirement

- Maximum Calculation: Caps benefits at 35 qualifying years for full entitlement

- Contracted Out Reduction: Applies adjustments for periods of contracting out

- Future Projections: Estimates additional qualifying years based on your future work plans

UK Mortgage Calculator

How It Works

The UK Mortgage Calculator helps you understand what you can afford, calculate monthly payments, and explore different mortgage scenarios to find the best option for your circumstances.

Key Features:

- Affordability Assessment: Shows how much you can borrow based on income and expenses

- Loan-to-Value (LTV) Calculator: Dynamic calculation of your LTV ratio and its impact on interest rates

- Repayment vs. Interest-Only: Compare different mortgage types and their long-term implications

- Additional Costs: Incorporates arrangement fees, valuation fees, and other purchase costs

- Overpayment Analysis: Shows how making overpayments can reduce your term and save interest

Calculation Methodology:

The calculator uses standard mortgage calculation formulas:

- Repayment Mortgage: Uses the formula M = P[r(1+r)^n]/[(1+r)^n-1] where M is the monthly payment, P is the principal, r is the monthly interest rate, and n is the number of payments

- Interest-Only: Calculates monthly interest payments without principal reduction

- Loan-to-Value: Calculated as (Mortgage Amount ÷ Property Value) x 100%

- Total Interest: Determines the total interest paid over the life of the mortgage

- Stress Testing: Assesses affordability if interest rates increase by various percentages

UK Savings Calculator

How It Works

The UK Savings Calculator helps you set and track savings goals, project how your money will grow over time, and understand the impacts of different interest rates and deposit frequencies.

Key Features:

- Goal-Based Savings: Set specific targets and see how long it will take to reach them

- Compound Interest Visualization: See how compound interest accelerates your savings growth

- Regular Deposits: Calculate the impact of consistent additional contributions

- Inflation Adjustment: Account for the effects of inflation on your savings' real value

- Tax Implications: See how different tax treatments affect your net returns

Calculation Methodology:

The calculator employs several financial formulas:

- Simple Savings: A = P(1 + rt) where A is the final amount, P is the principal, r is the interest rate, and t is time in years

- Compound Interest: A = P(1 + r/n)^(nt) where n is the number of times interest is compounded per year

- Regular Contributions: Uses the formula for future value of an annuity with compound interest

- Inflation Adjustment: Calculates the real (inflation-adjusted) value of future savings

- Goal Achievement: Determines the time or amount needed to reach specific savings targets

Data Sources & Privacy

How We Source Our Data

Our calculators use current and accurate data from multiple reliable sources:

- Government Resources: Official rates and rules from gov.uk, including State Pension, tax allowances, and National Insurance thresholds

- Pension Scheme Documentation: Direct information from Teachers' Pension Scheme, Armed Forces Pension Scheme, and other workplace pension providers

- Financial Industry Metrics: Current mortgage rates, savings interest rates, and investment return projections based on market data

- Actuarial Tables: Standardized longevity and retirement statistics for more accurate long-term projections

We regularly update our calculators to reflect changes in legislation, pension scheme rules, and economic factors, ensuring you receive the most current and accurate estimates possible.

Your Data Privacy

We take your privacy seriously when using our calculators:

- No Personal Data Storage: Our calculators process your inputs in real-time without storing personal information

- Local Calculations: Most calculations happen in your browser, not on our servers

- Optional Account Features: Creating an account to save results is optional and subject to our Privacy Policy

- No Data Sharing: We don't share your calculation inputs or results with third parties even don't store any data.

- Secure Connections: All calculator interactions are protected with SSL encryption

You can use our calculators with confidence, knowing your financial information remains private and secure.

Calculator Limitations & Considerations

While our calculators provide valuable insights for financial planning, they have certain limitations you should be aware of:

Projection Limitations

- Calculators use fixed growth/inflation rates, while actual rates fluctuate over time

- Results don't account for market volatility or economic downturns

- Long-term projections become less accurate the further into the future they extend

- Calculations assume consistent contributions without interruptions

Regulatory Considerations

- Tax rules, pension regulations, and benefits criteria change over time

- Calculations based on current rules may not reflect future legislative changes

- Special circumstances (like pension protections) may not be fully captured

- State benefits and allowances may change with government policy

Personal Factors

- Health considerations and life expectancy aren't personalized

- Career changes and salary fluctuations aren't automatically projected

- Family circumstances (marriages, children, etc.) may impact actual outcomes

- Individual investment choices can significantly affect actual returns

Best Practice Recommendations

- Use calculators as planning tools, not definitive forecasts

- Re-run calculations annually or when circumstances change

- Consult with financial advisors for personalized advice

- Combine multiple calculators for a more comprehensive view of your financial future

- Regularly check official sources for updates to pension schemes and tax rules

Important Note:

Our calculators provide estimates based on the information you provide and current rules. They are not a substitute for professional financial advice. For personalized guidance tailored to your specific circumstances, we recommend consulting with a qualified financial advisor or pension specialist.

Frequently Asked Questions

Our pension calculators provide estimates based on the information you input and current rules, rates, and legislation. For standard scenarios, our calculators typically achieve accuracy within 5-10% of actual outcomes when all inputs are correct.

Factors affecting accuracy include:

- Input Precision: The more accurate and complete your inputs, the more accurate your results will be

- Future Changes: Legislative changes, pension scheme rule updates, and economic fluctuations may affect long-term accuracy

- Complex Circumstances: Special situations like pension sharing orders, protected rights, or international pensions may require additional considerations

- Investment Performance: Actual investment returns will likely differ from the standard growth assumptions

For specialized pension schemes (Teachers', Armed Forces, etc.), our calculators incorporate scheme-specific rules and formulae to provide targeted accuracy for these professions.

For the most accurate projections, we recommend:

- Regularly updating your inputs as your circumstances change

- Using actual figures from your pension statements where possible

- Cross-referencing with official pension forecasts from your providers

The best calculator to use depends on your specific financial planning needs:

For Pension Planning:

- UK Pension Calculator: Best for general retirement planning that includes multiple pension types and sources of retirement income

- UK State Pension Calculator: If you want to understand your State Pension entitlement specifically

- UK Teacher Pension Calculator: Specifically for education professionals in the Teachers' Pension Scheme

- UK Armed Forces Pension Calculator: Designed for military personnel across all Armed Forces Pension Schemes

For Other Financial Planning:

- UK Mortgage Calculator: For home buying planning, understanding affordability, and managing existing mortgages

- UK Savings Calculator: For goal-based savings, emergency funds, and medium-term financial objectives

Recommended Combinations:

- Complete Retirement Planning: Use the general UK Pension Calculator plus the specialized calculator for your profession (if applicable), and the State Pension Calculator

- Home Buying + Retirement: Combine the Mortgage Calculator with the Pension Calculator to ensure your mortgage will be paid off by retirement

- Short and Long-term Planning: Use the Savings Calculator for immediate goals and the Pension Calculator for long-term security

For the most comprehensive financial planning, we recommend using multiple calculators to create a complete picture of your financial future across different timeframes and objectives.

We recommend recalculating your pension projections at specific intervals and key life events:

Regular Intervals:

- Annually: Review your projections once a year to track progress and make minor adjustments

- After Budget Announcements: Recalculate when there are significant changes to pension taxation, allowances, or State Pension rules

- When Receiving Pension Statements: Update your projections with the latest actual values from your annual pension statements

Life Events That Should Trigger Recalculation:

- Career Changes: New job, promotion, significant salary change, or reduction in working hours

- Pension Scheme Changes: Joining a new pension scheme or changes to your existing scheme

- Family Changes: Marriage, divorce, birth of children, or death of a spouse

- Contribution Adjustments: When you increase or decrease your pension contributions

- Approaching Retirement: More frequent calculations (every 6 months) as you get within 5 years of retirement

- Pension Transfers: After transferring pensions between schemes or providers

Age-Based Recommendations:

- Under 40: Annual reviews are typically sufficient

- 40-55: Biannual reviews to ensure you're on track during peak earning years

- 55+: Quarterly reviews as you approach potential retirement and access options

More frequent recalculations provide better visibility of your progress and allow you to make timely adjustments to your savings strategy if you're falling short of your retirement goals.

Our calculators make several standard assumptions to generate projections. Where possible, you can customize these, but it's important to understand the default assumptions:

Economic Assumptions:

- Inflation Rate: 2% per annum (can be adjusted in most calculators)

- Investment Returns: 5% per annum for moderate risk profiles (adjustable)

- Salary Growth: 2.5% per annum above inflation for standard career progression

- State Pension Increases: Following the triple lock (highest of inflation, wage growth, or 2.5%)

Pension-Specific Assumptions:

- Life Expectancy: Based on ONS average projection tables (age 88 for men, 90 for women)

- Annuity Rates: Based on current market rates for a single life, level annuity

- Drawdown Rate: 4% initial withdrawal rate for sustainable income (adjustable)

- Tax Rates: Current income tax bands and rates applied to pension income

- Contribution Consistency: Continuous contributions without gaps until retirement

Scheme-Specific Assumptions:

- State Pension: Full qualifying years achieved if currently on track

- Defined Benefit Schemes: Benefit accrual continues at current rate

- Armed Forces/Teacher Pensions: Current scheme rules remain unchanged

- McCloud Remedy: Standard implementation for affected public sector schemes

For more conservative planning, consider adjusting the default assumptions to test how your projections might change under different scenarios (e.g., lower investment returns, higher inflation, or earlier retirement).

Keeping our calculators aligned with current legislation, tax rules, and pension scheme regulations is a critical priority. We maintain accuracy through:

Regular Update Schedule:

- Annual Budget Updates: Comprehensive review after each UK Budget to incorporate tax changes and allowance adjustments

- Quarterly Review: Regular checks against government and pension scheme announcements

- Ad-hoc Updates: Immediate updates when significant legislative changes are announced

Monitored Information Sources:

- Government Legislation: Tracking UK Finance Acts and pension regulations

- HMRC Guidance: Following technical updates and tax manual changes

- Pension Scheme Rules: Monitoring changes to State Pension, public sector schemes, and standard defined contribution arrangements

- Financial Regulator Updates: Incorporating relevant FCA and The Pensions Regulator guidance

Verification Processes:

- Expert Review: Financial professionals verify calculator logic and assumptions

- Comparative Testing: Results benchmarked against official calculators and examples

- Version Control: Clear documentation of calculator versions and update history

Each calculator displays its last update date, and we provide notifications of significant changes that might affect your calculations. If you notice any discrepancies or have questions about recent regulatory changes, please contact us.

Related Resources

External Resources

Check your State Pension forecast

gov.ukOfficial government service to get a forecast of your State Pension based on your National Insurance record.

MoneyHelper Pension Guidance

moneyhelper.org.ukFree and impartial guidance on pensions and retirement planning from the Money and Pensions Service.

Pensions Advisory Service

pensionsadvisoryservice.org.ukIndependent guidance and information on all pension matters, including resolving disputes.

Take Control of Your Financial Future

Now that you understand how our calculators work, it's time to put them to use. Start planning for a secure financial future with our comprehensive suite of financial tools.